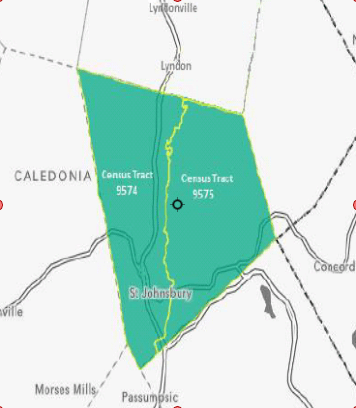

Opportunity Zone

The Tax Cuts and Jobs Act of 2017 created a new class of private investment vehicles called Opportunity Funds to encourage capital investments in projects located in economically disadvantaged census tracts.

These funds must be invested in the following:

- Projects that are in census tracts designated as Opportunity Zones

- Substantially all (90%) of the fund’s holdings must be invested in a Qualified Opportunity Fund (QOF).

How Do Opportunity Zones Work?

Investing in an Opportunity Zone

Public Service

Police Department Fire DepartmentMunicipal Offices

Town Manager Town Clerk & Treasurer Selectboard Assessor's Office Planning and ZoningSt J Rec Department Facebook Page

Visit Us on FacebookFor more information about Opportunity Zones please contact The Town of St. Johnsbury Economic Development Office at (802) 748-3926

ext. 5 or jkasprzak@stjvt.com