Tax Increment Financing (TIF)

Tax Increment Financing (TIF) is a tool that municipalities use to finance improvements for public infrastructure like streets, sidewalks and storm water management systems. The improvements serve a specified area known as a TIF District. Barre, St. Albans, Hartford and other Vermont towns have proven that TIF leverages additional private investment that builds and renovates the housing, commercial, and retail space needed to grow jobs and the economy.

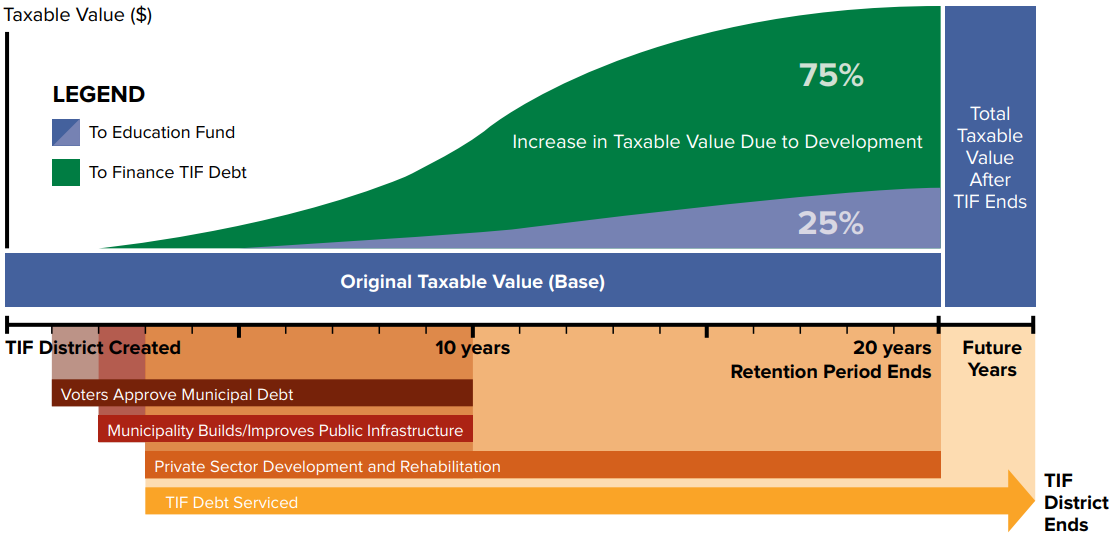

After creation of a TIF District by a municipality and approval by the state, voters authorize municipal bonds or other debt to finance construction or improvement of public infrastructure to serve the TIF District. As the infrastructure is built and improved, the private sector follows with investments in new and renovated buildings. This private investment incrementally increases the value of the grand list. The boost in the value of the grand list and the generation of incremental revenue are the result of the TIF financing that paid for the infrastructure improvements that attracted new investment, business and visitors.

While the infrastructure debt is being repaid, the entire Original Taxable Value, or base level of annual property taxes generated within the District goes to the Education Fund. Of the increased property tax revenue, up to 75% is retained by the municipality to finance infrastructure debt. A minimum of 25% of the increased revenue is sent to the Education Fund. After 20 years, the grand list value of the properties within the TIF District are substantially increased because the infrastructure investment supports and enables increased private sector investment. From that point forward, the base and the entire increase in property tax revenue are paid to the Education Fund in perpetuity.

Tax Increment Financing: Timeline and Revenue Distribution